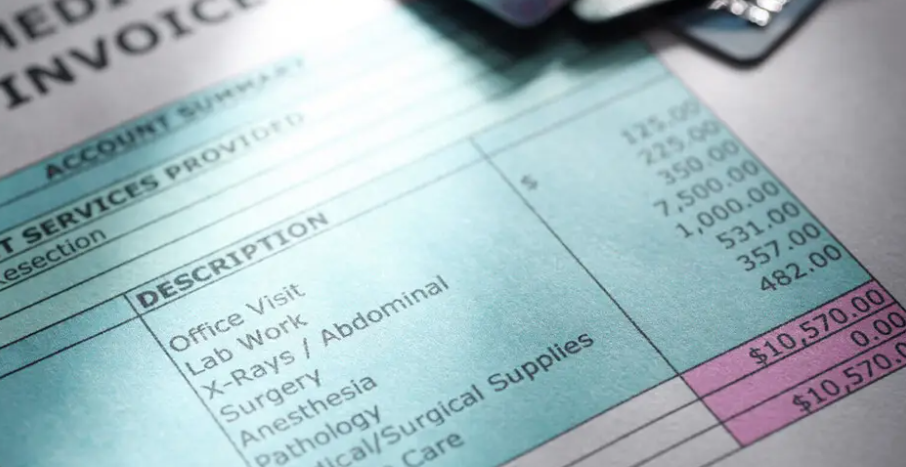

After July 2022, even hospitals have been brought under the ambit of the GST taxation system. However, do not get fooled if the hospital adds GST on the total bill during your discharge, because all the healthcare services are not taxed by the government.

For this, you need to know what is included in the GST and what healthcare services are exempted from it.

The healthcare services delivered by clinical establishment’s, authorised medical practitioners or paramedics are exempted under GST. However, this exemption will not be available to the services rendered in the form of provision of a room (excluding intensive care unit (ICU)/critical care unit (CCU)/neonatal intensive care unit (NICU)) by a clinical establishment for an amount exceeding Rs 5,000 per day. Furthermore, no input tax credit (ITC) can be claimed on these hospital room services.

Doctors’ consultation and treatment provided to patients at the Outpatients Department (OPD) without admission to the hospital/clinical establishment are exempted from GST.

Inpatient services, including doctors’ fees and consultancy charges, and supply of medicines, implants, consumables, bed charges, operation theatre rent, equipment charges, etc., are exempt from GST and are considered a composite supply. However, when medicine and food are offered on an optional and distinct basis, then GST needs to be paid.

No GST is incurred on medical tests carried out in clinical establishments.

The services provided by blood banks for preserving stem cells are exempted from GST.

The healthcare services offered in the form of a patient’s transportation in an ambulance, are also exempted from GST levy.

Services provided by a veterinary clinic for treating animals or birds are also exempted.

Similarly, in the case of medicines and medical supplies, not all items attract the same GST rate. Please remember, that human blood and its components by-products used in medicine, all kinds of contraceptives and sanitary napkins or tampons are GST-free in India.

These items/medicines have 5% GST on them:

Animal or human blood vaccines, insulin, oral rehydration salts, diagnostic kits for detection of all types of hepatitis, Drugs or medicines including Dopamine, Penicillamine, Influenza Vaccine, Protamine, BCG vaccine, Streptomycin, Pyrazinamide, Hydrocortisone, Quinine, amongst 200+ other specified drugs, artificial kidneys, disposable sterilized dialyzer or micro barrier of the artificial kidney, artificial limbs, orthopedic appliances that include crutches, surgical belts and trusses; splints and other fracture appliances; artificial parts of the body, parts of wheelchairs, tricycles, braillers, crutches, walking frames, etc, coronary stents/stent systems for use with cardiac catheters, ostomy appliances, milk food for babies and COVID-19 diagnostic test kits.

12% GST:

Animal blood for therapeutic, prophylactic or diagnostic uses, antisera and other blood fractions and modified immunological products, toxins, cultures of microorganisms (excluding yeasts) and similar products, medicaments of ayurvedic, homoeopathic, unani, siddha, or biochemic systems, Wadding, bandages, gauze, and similar articles, tooth powder, feeding bottles and nipples of feeding bottles, surgical rubber gloves or medical examination rubber gloves, X-ray machines, and other similar apparatus used for surgical, medical, dental or veterinary uses, contact lenses, spectacle lenses and corrective spectacles, blood glucose monitoring system (glucometer) and test strips, medical grade oxygen, medical grade hydrogen peroxide.

Please remember that no pharmaceutical products or medicines are taxed at 28% GST.

So next time you get admitted to a private hospital, do not forget to check the GST rates levied on your bill during your discharge paperwork

Thank you for the auspicious writeup It in fact was a amusement account it Look advanced to far added agreeable from you However how can we communicate

I enjoyed it just as much as you will be able to accomplish here. You should be apprehensive about providing the following, but the sketch is lovely and the writing is stylish; yet, you should definitely return back as you will be doing this walk so frequently.

Magnificent beat ! I would like to apprentice while you amend your site, how can i subscribe for a blog web site? The account helped me a acceptable deal. I had been a little bit acquainted of this your broadcast offered bright clear idea

What i do not understood is in truth how you are not actually a lot more smartly-liked than you may be now. You are very intelligent. You realize therefore significantly in the case of this topic, produced me individually imagine it from numerous numerous angles. Its like men and women don’t seem to be fascinated until it is one thing to do with Woman gaga! Your own stuffs nice. All the time care for it up!

I have been browsing online more than three hours today yet I never found any interesting article like yours It is pretty worth enough for me In my view if all website owners and bloggers made good content as you did the internet will be a lot more useful than ever before

I thoroughly enjoyed the work that you have accomplished here. The sketch is elegant and your written material is stylish as well. However, you may develop a sense of apprehension regarding the delivery of the following; however, you will undoubtedly revisit since the situation is virtually identical if you safeguard this hike.

Hello Neat post Theres an issue together with your site in internet explorer would check this IE still is the marketplace chief and a large element of other folks will leave out your magnificent writing due to this problem

helloI really like your writing so a lot share we keep up a correspondence extra approximately your post on AOL I need an expert in this house to unravel my problem May be that is you Taking a look ahead to see you